Wondering how to pay off medical school debt fast? We’ve got some tips and strategies for you. It’s no secret that medical school tuition in the US and Canada can get very expensive, and more than half of medical school graduates have student loan debt to repay. Without a proper plan for paying back student loans, even the highest-paid doctors can spend decades with mountains of debt. The good news is that there are a variety of steps that you can take to eradicate your debt faster. This blog will walk you through eight different strategies and give you some tips to help you pay off your medical school debt fast.

>>Want us to help you get accepted? Schedule a free initial consultation here <<

Medical school is expensive, but students often assume that when they are done with residency, they’ll start making “the big bucks,” making paying off their student loans easy, but things are not that simple. The reality is that 76% of medical school students graduate with debt, and while that percentage has decreased in the last few years, the amounts have increased alongside the cost of tuition. The median debt for medical school graduates in the US is currently $241,600 in total.

So, with that in mind, let’s take the example of a pediatrician. The average pediatrician makes an annual income of $250 000, a very healthy sum of money. However, between the cost of your mortgage or rent, car payments, insurances, utilities, taxes, and daily expenses, it can take years to pay down $241,000 worth of debt on a $250,000 salary without the right plan.

That said, you should not let the fear of debt get in the way of you and your dream career. Whether you’re still wondering if medical school is right for you, are already in the thick of it, or have already graduated, tuition fees and medical school debt have most likely crossed your mind more than once. If you’ve decided that medical school is worth it for you, we have some good news: there are ways to reduce and eventually eradicate your debt fast. We talk about some of those ways in detail below, so keep reading.

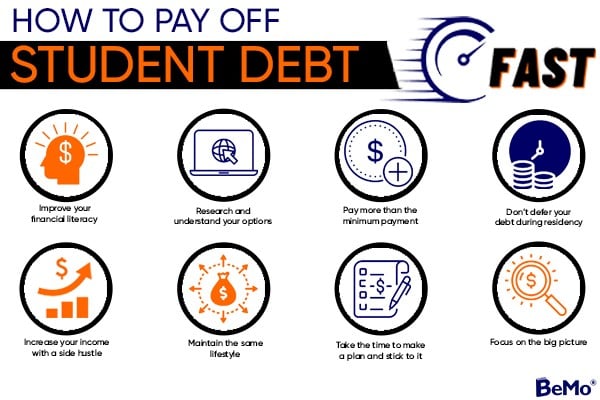

Want a quick summary of the key points we will cover in this blog? Check out this infographic:

1. Improve your financial literacy

It may seem obvious, but the smarter you are about finances, the better you will be at managing debt. Financial literacy helps you understand how to allocate your income toward several goals simultaneously - including the repayment of your medical school debt. It also helps with keeping track of ongoing expenses and building up your savings for emergency funds, retirement, and other plans that you may have. Understanding finances will also give you the tools required to thoroughly research and evaluate loans, credit cards, lines of credit, and investment opportunities. That way, even if you don't have a lot of disposable income, you will know how to prioritize your goals and make strides.

Some medical schools actually have resources to help future physicians with this aspect of their lives. The University of South Carolina School of Medicine, for example, gives students the opportunity to participate in one-on-one meetings about finances in their first and fourth years. During these meetings, they discuss different aspects of financial planning, from budgets to expenses and loan repayment options. If you didn't participate in something like that in school, you could still improve your knowledge of financial systems. Many well-regarded agencies and non-profits offer free financial literacy resources. To get you started, here are three examples you can look into:

The Consumer Financial Protection Bureau's website provides a lot of great information about how to approach major financial decisions such as paying for college or getting an auto loan.

2. Research and understand your options

Financial literacy will come in very handy when you're going through this step, and it is a necessary step to take if you want to pay off your medical school loans fast. In order to make a plan for how you will pay off your student debt, t's imperative that you find out exactly what options are available to you. Take the time to research and find out everything you can about the student loan repayment process, the repayment assistance programs, student loan forgiveness programs, income-driven repayment plans, and refinancing plans.

Most of these programs will not make your debt disappear, but they can help you reduce it significantly. Let's look at student loan refinancing plans, for example. Refinancing your student debt basically means replacing one or more existing loans with a new one through a private lender. Most people who consider this option do so because student loans typically have high-interest rates. High-interest rates can cause your debt to grow rapidly, and when you're paying a lot in interest, it can be challenging to pay off the principal. You are more likely to qualify for a lower rate by refinancing your loan - depending on your income and credit history, of course. If you do not take the time to research and find out what programs or plans you may qualify for, you could miss out on this opportunity to save money and reduce your monthly payment.

3. Don’t defer your debt during residency

Most of the time, medical school loans enter repayment six months after graduation. It is possible to postpone student loan payments during your residency or fellowship, and most graduates take advantage of this option because of the relatively low salary they will get as a resident. What most students do not realize is that deferring the loan during residency does not stop it from accruing interest, thus costing you more money. To put that into context, let's assume that you are graduating with a $200,000 balance on your loan and a 5.3% interest rate. Deferring these loans for a three-year residency would add $31,800 in accrued interest, bringing your new balance to $231,800. Your monthly payments of $2,492 on a 10-year payment plan would be $342 more than the monthly payments without the deferment.

To save on interest and pay off the debt faster, we recommend that you budget your expenses in a way that prioritizes your student loan during residency. A typical resident doctor in Canada and the United States gets an average annual salary of $60 000. It would be best if you planned to continue living like a student and make full, or at least partial, repayments every month. You should only use deferment and forbearance only as a last resort.

Want to know more about salaries during residency? This video will walk you through it:

4. Increase your income with a side hustle

Side hustles are a great way to make some extra money to put towards your goals. Some people take these second jobs on to supplement their income, but if your aim is to pay off your student loans faster, you can use the money from it for that specifically. If you're not sure where to start, here are a few medical side hustles that you can look into:

Telemedicine: Technology has given us telemedicine apps and websites that are becoming increasingly popular. It is now possible for doctors to "see" patients from the comfort of their own homes, and you can be pretty flexible with your work hours. If your regular schedule includes a specific day off, you could use that day to see patients and earn extra income.

Medical surveys:This is not the kind of hustle that can turn into a full-time job, but it can bring it a decent amount of extra money. Research companies will pay anywhere from $25-50 for a 5–10-minute online survey to several hundred dollars for a more extensive one. Many of these surveys are done online or over the phone, giving you the freedom to do them almost anywhere. The topics can cover new medications, devices, treatments, insurance-related questions, etc.

Review Insurance claims: Insurance companies often need independent physicians to review insurance claims or pre-authorization. This is common for cases that involve new treatments, experimental procedures, or cases that the insurance company suspects to be elective rather than medically necessary. They also use this service when an insurance decision is appealed, and an independent review is required. This gig can be time-consuming, but it can also be pretty lucrative.

Technical writing:There is quite a bit of money to be made by writing for doctors. There are medical publications that need physicians who can write articles and other magazines or websites that require a physician's input for specific topics. Also, pharma companies often need someone to write the copy for the marketing brochures they distribute to physicians or summaries for new drugs being introduced to the market. All these companies are willing to pay a little extra for a practicing physician's knowledge.

Furthermore, if you want to take a break from medicine with your side hustle, you always have the option of investing your money in things like real estate or the stock market, you can also learn a new skill or look for ways to monetize one of your hobbies. For example, if you enjoy taking pictures and you're pretty good at it, why not invest in a good camera and some editing software so that you can offer your services as a photographer?

5. Minimize lifestyle inflation

If you ask most good physicians “why do you want to be a doctor”, they are very unlikely to say that it’s because of the money. That said, we can't deny that the salary is a nice perk. It's, therefore, natural to want to enjoy it when you start making the big bucks that you were promised. There is nothing wrong with doing that, but if you wish to pay off your student loans faster, we recommend that you minimize your lifestyle inflation. Meaning that you keep your costs low so that you can make additional payments towards your debt.

There are several ways to do this and figure out which method is best for you; you'll need to sit down and analyze your expenses, lifestyle, and priorities, then decide how much more you want to be putting towards your debt repayment every month. For example, some doctors choose to live with a roommate for two or three years. Others might decide to put off making any big purchases until they've paid off their loans.

One way that we can recommend is to keep living like a resident and put all of your new income towards your goals. For example, let's say that you were making $45 000 as a resident, and your new salary as an independent physician is $100 000. You can keep living the same way you did when you only had $45000 a year to work with, and you will have $55 000 to use for your loan repayment and to put towards your savings for other plans you have. By following this method, you'll be able to pay off your medical school debt in a few years, and afterward, you can start to lead a lifestyle that matches your income with no debt hanging over your head!

6. Take the time to make a plan and stick to it

When students are about to graduate from medical school, they have a lot going on. Debt management can easily fall through the cracks between navigating ERAS or CaRMS, studying for exams like the USMLE, and getting ready for this big transition in their lives. It is often easier to just put it all on hold until after residency, but that can be counterproductive. It is essential that you take the time to research your options and set a solid loan repayment plan in place. This will help you pay down your loans faster, and it will also allow you to balance your debt with other financial goals, such as purchasing a home or making other investments.

You can set up a plan by following the following steps:

Ask yourself the following questions: How much do you owe for medical school? Do you have any loans from your pre-med degree? What assets do you own, if any? Do you have any savings or any other debts like credit cards? That list is not exhaustive, but it should give you a good idea of where to start. Be honest with yourself and write down the answers to these questions. Knowing exactly what you're dealing with is the best way to develop a realistic plan. Are you hoping to pay off your loans in five years and buy a home five years after that? Do you want to finish residency with no student debt? Do you want to start building a travel fund? Whatever financial goals you have, we recommend writing them down first. Even the ones that seem a little far-fetched. This way, you'll be able to look at your current financial situation, as well as your financial goals, and figure out how much money you need to get there. Speaking with a loan repayment expert and a financial advisor will save you a lot of time, headache, and money. They'll be able to assess your debt, your current income, and your potential future income. They can then help you balance those with your student debt and other goals, including tax planning, investing, and retirement planning. Using the information from the previous steps, you can create a repayment plan that will work for you and stick to it. We recommend that you set up automate all the payments that you can to reduce the likelihood of you deviating from the plan.

7. Pay more than the minimum payment

It may be a little tough to pay extra right out of medical school or while in residency, but we encourage you to start making extra payments on your student loans once you can afford it. If your monthly payment is $600, you can choose to pay $650 or $700 per month instead. Or if that’s just not feasible for you, you can opt to put your “extra” income, such as raises, tax refunds or performance bonuses, towards your student debt. Not only does it allow you to repay your medical school debt faster, but it also lowers the amount of student loan interest you’ll pay. So ultimately, spending a little more money right now will make your debt cost you less in the long run.

Speaking of making extra income, signing bonuses are very common for doctors. Especially in communities where doctors are needed, and hospitals are therefore looking for ways to attract physicians. We recommend putting all or at least half of your signing bonus towards your student loans. These bonuses range from $2 000 to upwards of $30 000, depending on your specialty and the hospital or practice you'll be working with. Throwing this lump sum at your loans can go a long way towards shortening your repayment period and saving you money.

8. Focus on the bigger picture

The truth of the matter is that if you want to pay off your medical school debt fast, then you do have to make some compromises for a few years. Taking on a side hustle will mean sacrificing some of your free time, and minimizing lifestyle inflation will mean not spending your money the way you had hoped to. These things are not always easy to do, but they are necessary if you want to pay off your loans as fast as possible. Remind yourself of the end goal and the bigger picture to keep yourself on track.

Being able to pay off your medical debt will give you a more financially secure life, which will make it possible to accomplish your other financial goals faster. Picture yourself making that final payment in a couple of years and imagine how it will feel not to have all that debt hanging over your head. It sounds good, doesn't it? If you follow the tips that we've outlined above, that could be you in no time.

FAQs

1. How much debt does the average medical school graduate have?

The average medical school graduate owes $241,600 in student loan debt. This can include student loans for undergrad, medical school, and other educational expenses.

2. Are there any side hustles that doctors are qualified for?

There are many side hustles that doctors are especially qualified for. Some examples include telemedicine, insurance claim consulting, and medical copywriting.

3. What is lifestyle inflation?

Lifestyle inflation refers to the increase in spending that usually occurs when an individual’s income goes up.

4. Where can I find resources to become more financially literate?

Many financial planning websites provide helpful information. You can also check out The Association of American Medical Colleges (AAMC) website for free financial planning and educational debt management resources.

5. Can I start paying off my student loans during residency?

Yes, you can, and we recommend that you do if it’s feasible for you. Residents don’t make a lot of money, so you will need to go through your finances and see if you can make partial or full payments on your loan while you complete your residency.

6. Is medical school worth the headache and debt?

Only you can answer that question! Ask yourself why you want to be a doctor and decide based on that answer.

7. Do Doctors make enough to pay off student loans quickly?

In short, yes, but really, it depends on your specialty, where you work, how much debt you have, and what you’re willing to do to pay off those loans quickly. Even on a $300 000 annual salary, it can take a while to pay off a $200 000 loan without the right plan.

8. How long does it take to pay off medical school debt?

It can take anywhere from 2-5 years to twenty-plus years. It all depends on how much debt you have, your specialty, where you work, and your repayment plan.